Collimating lenses are optical lenses that help to make parallel the light that enters your spectrometer setup. These lenses allow users to control the field of view, collection efficiency and spatial resolution of their setup, and to configure illumination and collection angles for sampling

collimator is a device that narrows a beam of particles or waves. To narrow can mean either to cause the directions of motion to become more aligned in a specific direction or to cause the spatial cross section of the beam to become smaller (beam limiting device).

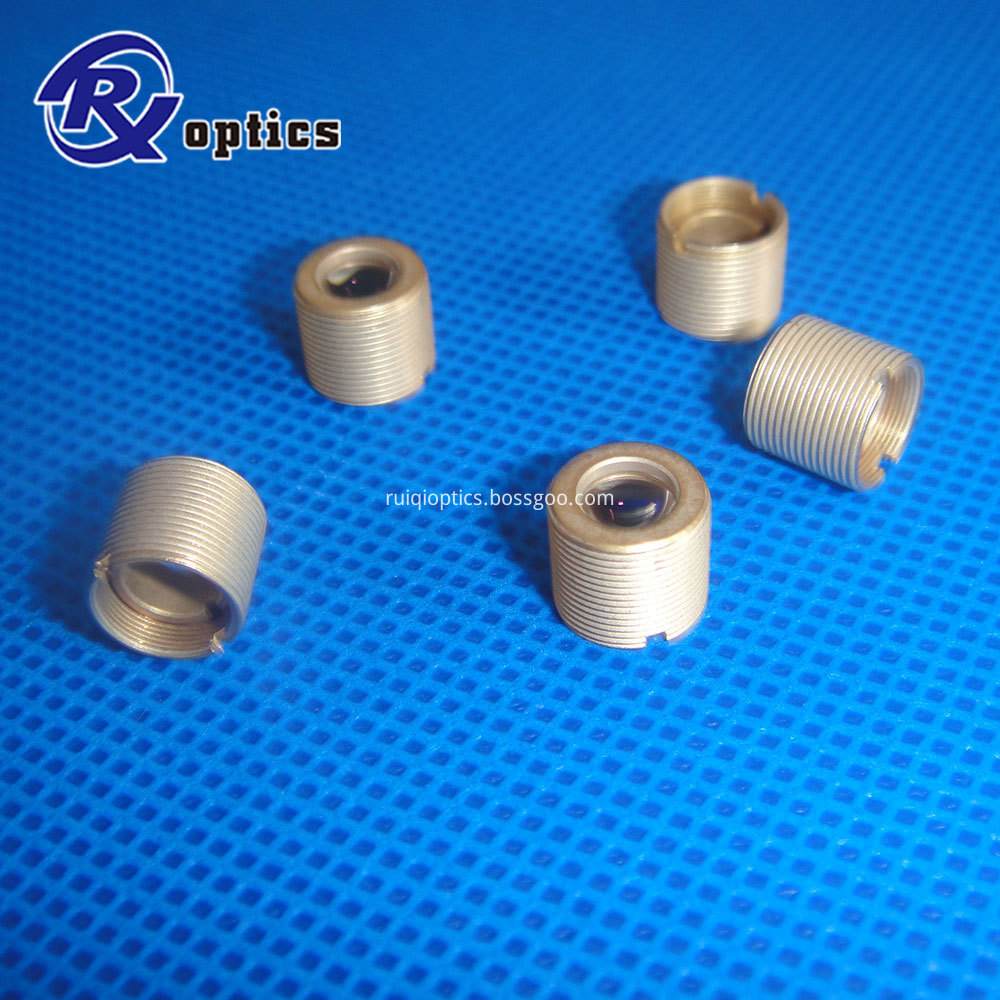

The molding glass collimator lenses are mainly designed with aspherical surface and made by molding technology.

Changchun Ruiqi now offer molding glass collimator lens--M series.The advantages of aspherical surface include small size,high performance,stable quality control in mass production and low cost comparing to traditional ground lens.Therefore, molding glass collimator lenses are commonly used in variety of applications,like industrial laser marking and detecting distance meters,laser projection and laser optical system.

Property

Molded Glass, aspheric Surface as laser collimator

Application

Optical Collimator Lens,Collimating Aspheric Lenses,Collimator Lens For Laser,collimating lenses Changchun Ruiqi Optoelectronics Co.,Ltd , https://www.ruiqi-optics.com

The price war in the photovoltaic industry is once again heating up the single polycrystalline battle is really a "cost-effective" dispute (

The technical route of the industrial level has never stopped, but sometimes it is sometimes smoked, sometimes it is undercurrent, and sometimes it becomes a kind of "scorpion" of the game. From October 2017 to the present, the “top†of renewable energy – the photovoltaic industry, a name that has been labeled as “technical routeâ€, has become more and more intense and open to competition around product prices. On October 27, 2017, Longji, the “leading big brother†of the A-share photovoltaic industry monocrystalline camp, announced that its monocrystalline silicon wafers were reduced by 0.4 yuan/piece, and 190um monocrystalline silicon wafers were 6.15 yuan/piece. Dropped to 5.75 yuan / piece, 180um single crystal silicon wafer from 6 yuan / piece to 5.6 yuan / piece. What surprised most outsiders was that in the next four months, Longji shares were again on December 25, 2017, January 1, 2018, February 4, 2018, and 2018. On the 23rd of the month, the price of monocrystalline silicon wafers was reduced four times, counting the first time on October 27, 2017, and the five adjustments totaled 1.5 yuan/piece, taking 180um monocrystalline silicon wafer as an example. The cumulative decline has exceeded 24%. For the price reduction, in the materials sent to reporters on a Longji share, the chairman of the company, Zhong Baoshen stressed that “this time (price reduction) is a principle that does not sacrifice the sustainable development of the company, rational, and controls the scope. Confidence, the normal behavior of providing value to customers.†However, according to the above trend, after consulting the price fluctuation of polysilicon wafers from 2016 to 2017, the reporter still felt the pressure of “single crystal campâ€: 2016 The price of polycrystalline silicon wafers has dropped by as much as 30%. As a result, at the beginning of 2017, the price difference between single polycrystals reached 1.2 yuan/piece-1.8 yuan/piece, of which the price of polycrystalline silicon wafers was between 4.5 yuan/piece-5.3 yuan/piece. The price of monocrystalline silicon wafers is between 6.3 yuan / piece - 6.5 yuan / piece. The industry believes that the "polycrystalline camp" has also been closely watching the "single crystal camp" every move, and waiting for an opportunity. Otherwise, the price of polysilicon will not be in October 2017, after Longji launched a price cut, it immediately ended the pace of July-October 2017 (from 4.9 yuan/piece in July to 5.2 in October). Yuan/Piece), from the recent high of 5.2 yuan/piece, all the way down to 4.8 yuan/piece in December 2017. Single-poly crystals in the efficiency and cost of each of the two sides of the game are from the "single crystal camp" and "polycrystalline camp", but I do not know that the camps intentionally, or public opinion rendering, this is just the product price The dispute was finally labeled as "a dispute over the technical route between single and multiple crystals." In the course of the "Securities Daily" reporter interview, the vast majority of industry people relished the "photovoltaic industry began in single crystal, and the birth of polycrystalline is to reduce costs." They generally believe that "relative polycrystalline, single crystal is not a more advanced photovoltaic technology", and "in the face of more and more photovoltaic applications, the price advantage of polycrystalline, so that it has a stronger industrialization than single crystal. ability". But even if this is the case, no matter which camp they come from, they all agree that "single crystals have a conversion efficiency advantage of 1%-2% compared to polycrystals due to lattice regularity." Compared with the natural advantage of single crystal in conversion efficiency, a technician who did not want to be named told the "Securities Daily" reporter that "the current polycrystalline cost advantage is mainly reflected in the long crystal end. The polycrystalline ingot furnace passes the thermal field. Reconstruction, the single-furnace production will increase from 350 kg to 1200 kg of G7, and will be upgraded to G8 furnace in the future. After several times of changing the furnace type, even if several continuous technologies are introduced, the monthly output of single furnace is only cast. A quarter of the ingot technology.†That is to say, if the “price/performance ratio†that is most valued by the market is likened to a scale consisting of efficiency and cost, the single polycrystals each have a weight. "Value-for-money" Libra swings around "cost-effective", based on single crystal natural crystals with 1% to 2% conversion efficiency advantage, the industry recognized - single polysilicon sheet price difference of 0.6 yuan / piece for watershed, more than 0.6 yuan /Piece polycrystals have advantages, and vice versa. As mentioned above, before 2016, the cost difference between single crystal and polycrystalline silicon wafers was even higher between 0.8 yuan and 1 yuan per piece, far higher than the price/performance ratio gap of 0.6 yuan per piece. However, the trend of this scale was changed in 2016 by a new technology called "Golden Wire Cutting". According to relevant records, Longji shares of the “leading big brother†of the single crystal camp began to pay attention to “Kinggang line cutting†from 2012. In 2013, the company started to quote, and by the end of the first quarter of 2014, its diamond wire cutting project achieved a profit and loss until 2015. At the end of the year, the company basically completed the replacement of cutting equipment, and has about 200 diamond line special planes. It is the effectiveness of new technologies (except for diamond cutting, and continuous feeding technology). In addition to the expansion of scale, the market share of single crystals has increased since 2016. In addition to technology and scale, the industry generally believes that from 2016 to 2017, the single crystal has also received policy "assisted", due to the implementation of the National Energy Administration "photovoltaic power generation leader plan" for the single crystal standards are more relaxed, large The proportion of single crystal products into the "leaders" project has also become an important reason for the increase in the market share of single crystal. The data more objectively recorded this "unusual" change: before the polysilicon film launched a cumulative price increase of 30% in 2016, due to weak market demand, the price of single polysilicon wafers even went upside down in the first half of 2016. That is, the price of single crystal silicon wafer is lower than that of polycrystalline silicon wafer After that, despite the cumulative price reduction of polysilicon wafers by 30% in 2016, the high-efficiency polycrystalline silicon wafers were lowered to 4.7 yuan/sheet to 4.8 yuan/piece in the first three quarters of 2016-2017, and the price of monocrystalline silicon wafers did not fall. Maintained at the level of 6.4 yuan / piece to 6.5 yuan / piece (relative to the silicon wafer, in the first three quarters of 2017, the single crystal module maintained a high level of 3.2 yuan / watt, the price of high efficiency polycrystalline components is always maintained at 2.8 yuan / watt The spread widened to 0.4 yuan / watt). The industry believes that this "unusual" change is mainly affected by the integration of the "leaders" project. “Because the 'Photovoltaic Power Leaders Program' set a relatively loose standard for the single crystal project, the applicants originally designed the bidding technical solution based on single crystal. Since then, although the cost-effective Libra has greatly favored polycrystalline (single polysilicon wafer) The price difference reached 1.7 yuan / piece), but helpless, it is also necessary to purchase single crystal components according to the original bidding technical plan." The above technical staff told reporters. Single crystal is the first to enjoy the new technology dividend. It seems that the "cost-effective" scale will not be cured by the natural advantages of single polycrystal. In other words, if we do not consider external influences such as policies, the successful application of new technologies may be the most important factor in determining the market pattern through “cost-effectiveness†and the weight of the stage. However, the reporter found that at present, polycrystalline seems to be at a disadvantage in the application of new technologies, such as the application of "golden wire cutting" technology. "The reason why the diamond wire cutting is first applied to single crystal silicon depends mainly on two points: First, the diamond wire cuts the polycrystalline silicon wafer, resulting in higher reflectivity, and the conventional polycrystalline texturing process is difficult to achieve good results; second, Due to the relatively high cost of polycrystalline crystals, based on competition considerations, more power is preferred to adopt the new technology of diamond wire cutting, and it is earlier to break the break-even point." The above technician told reporters, "In fact, in addition to diamond cutting Since the development of single crystal structured lattice structure is easy to improve, technologies such as PERC, IBC, double-sided, half-chip, and tiling, which are improved by batteries and components, are also first developed and promoted on single crystals. In the eyes of many people in the industry, it is often the first to enjoy the dividends of new technologies in reducing costs and increasing efficiency. This is an important factor in the total capacity of the single-crystal camp to turn the tide and resolve the unfavorable situation. However, the polycrystalline camp certainly won't sit still. In order to break through the diamond cutting of polycrystalline silicon wafers, resulting in higher reflectivity hindrance, starting in 2017, polysilicon camp "leading boss" - GCL-Poly is the first to match the black silicon texturing technology, thus achieving large-scale promotion of diamond wire cutting transformation. The data obtained by the "Securities Daily" reporter showed that after the transformation, the polysilicon wafer was reduced by 0.5 yuan/piece, the black silicon processing cost was controlled at 0.1 yuan/piece, and the power gain was increased to 5 watts. According to the current component price calculation, the black silicon component has a gain of 0.05 yuan / watt, and the cost only rises by about 0.02 yuan / watt. On this basis, polycrystalline black silicon can also obtain additional benefits after superimposing PERC technology, and the efficiency is higher than ordinary polycrystalline PERC by more than 0.4%. It is understood that GCL's integrated mass production of black silicon PERC cells has exceeded 21% efficiency. In addition to the diamond wire cutting, the above-mentioned technicians said, "At present, it seems that in the single crystal production technology, polycrystalline will be rolled out." The change in the market structure behind the price reduction was issued to the securities in Longji. In the materials of the reporter of the Daily News, Zhong Baoshen also said, “Now (after the price cut), the profit of each of our monocrystalline silicon does not have much higher prices. But it does not affect the healthy development of the company.†In addition, the Longji shares are adjusted. The official response given by the price said that the adjustment price is mainly based on two aspects: First, with the gradual release of Longji’s 10G watt capacity in three bases in Yunnan, the supply of monocrystalline silicon wafers is becoming more and more abundant, and the price is based on the current supply and demand situation. Secondly, the gradual downward adjustment of PV feed-in tariff will have a certain impact on the profit of the terminal investors. In order to cooperate with the profit-making terminal, Longji decided to continue to adjust the price of monocrystalline silicon wafers to better promote the parity of the Internet and promote the development of the industry. . Then, before the price of the Longji shares was more than 24%, what changes have occurred in the market structure? In this regard, the reporter did not collect enough data, but it is representative that, according to customs statistics, China exported about 31.8 GW of polycrystalline components in 2017, and 5 GW of monocrystalline components (13.2%). . In this regard, the industry has analyzed that in the first three quarters of 2017, the single crystal module maintained a high level of 3.2 yuan / watt, while the price of high-efficiency polycrystalline components has always remained at 2.8 yuan / watt, the spread widened to 0.4 yuan / watt. In addition to the “Top Runner Program†project, which must purchase single crystal components in accordance with the bidding technical plan, other projects have changed their designs to purchase cost-effective polycrystalline components. Since the second half of the year, most of the market has been occupied by more cost-effective polycrystalline products, especially in overseas markets. In the third quarter of 2017, the “201†clause prompted the United States to rush to import Chinese PV modules. Many domestic “leaders†projects were postponed to the grid, and many factors affected the PV market. Since September 2017, market demand has turned downwards. Due to the high price of single crystal products, demand has dropped sharply, especially in terms of exports. The price of single crystal modules has rapidly dropped from 3.2 yuan/watt to 2.9 yuan/watt. Especially in September to October 2017, monocrystalline silicon wafers were even slow-moving. The price of monocrystalline silicon wafers has been reduced. The reporters have compiled according to the relevant industry quotations. After the price reduction, the current price of Longji single crystal silicon wafers is 4.55 yuan/piece, followed by the quotation of the polysilicon wafers. About 3.8 yuan / piece, thus, the single polycrystalline price difference is allowed to remain above 0.6 yuan / piece, reaching 0.75 yuan / piece. According to the reporter's understanding, similar to the first half of 2016, in some parts of the world, the price of single polycrystalline components has once again appeared upside down. For example, the current lowest price of overseas single crystal PERC components has dropped to 32 cents / watt (about 2.3 yuan / watt), lower than the price of polycrystalline components. Some people in the industry believe that single-crystal PERC cells are reduced to about 1.6 yuan / watt, and downstream products are produced with 4.55 yuan / piece of monocrystalline silicon wafers. It is difficult for monocrystalline battery component manufacturers to make profits. Therefore, unless the single-crystal camp launches a more thorough price cut, this upside down phenomenon will not be maintained for a long time. In addition, the more serious of the single crystal camp is that in the medium term, following the single crystal camp, at present, the polycrystalline camp, such as GCL-Poly, has basically completed the transformation of more than a thousand slicers, and its diamond fiber cutting polycrystalline production capacity is still In the continuous release, the black silicon technology of major PV companies has also been mass-produced. However, the single polycrystalline efficiency has been maintained at 1.5% for a long time, but in the past year, polycrystalline has adopted the diamond wire + black silicon + PERC technology to increase the mass production efficiency of polycrystalline cells to over 20.5%, and the amount of single crystal PERC. The productivity difference narrowed to 0.7% to 0.8%. According to estimates, the price/performance ratio of the single polycrystalline component end has dropped from 0.1 yuan / watt to 0.06 yuan / watt, then, conducted to the silicon wafer end, calculated according to 5 watts / piece, the single polycrystalline cost performance standard difference has even been from the previous 0.6 Yuan / film, down to 0.3 yuan / piece. However, in terms of market share, although it did not reach 40% of the forecast at the beginning of 2017, under the leadership of Longji, the single-crystal camp has achieved a major breakthrough, changing the market share of the previous market share to remain at around 20%. The market share has pushed up to nearly 30%. According to PVInfoLink statistics, in 2017, the global PV installed capacity was 103 GW and the single crystal reached 29 GW. Not only that, before the publication, the bidding for the third batch of PV front-runners in 2018 showed that the Baicheng 500 MW project was awarded the ultra-low price of 0.41 yuan/degree to 0.45 yuan/degree, and the winning technology route was single crystal. It is worth mentioning that the industry analysts believe that the successful bidders have basically no PV manufacturing capacity, and the low price reported may force the manufacturing end to provide efficient components with lower prices. According to estimates, P-type or N-type single-crystal PERC single-sided 310-watt to 370-watt components must be reduced to 2.5 yuan / watt, back to the silicon end, the price should be reduced to 3 yuan / piece the following. That is to say, the monocrystalline silicon wafer still needs to further reduce the price.