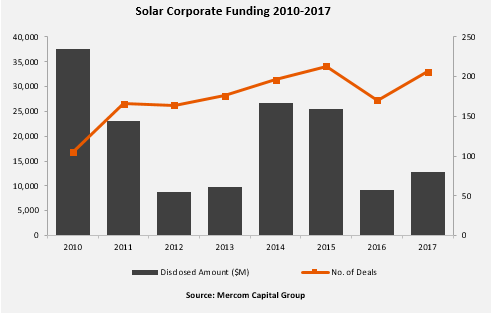

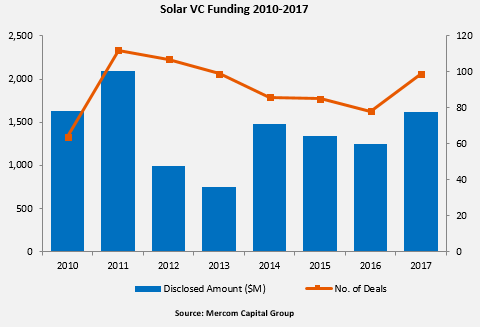

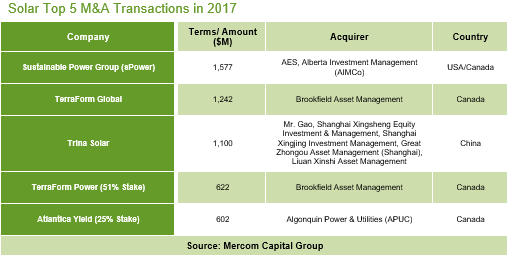

Mercom Capital, the global clean energy communications and consulting firm, today released its annual report on solar industry financing and M&A activity in 2017. Global companies have raised $12.8 billion in financing for the solar industry, up 41% from 2016's $9.1 billion, including Venture capital / private equity (VC), debt financing and public market financing. Mercom Capital CEO and co-founder RajPrabhu commented, “The strong fourth quarter pushed the overall financing level higher in 2017. The global solar installations continue to increase, the US solar investment tax credit does not pose too much threat, the US ITC tariffs Less than expected, strong debt financing activities, and more than $1 billion in securitization transactions helped the solar industry's financial activities in 2017 be much better than in 2016. After years of challenges, most solar securities rose in 2017, reflecting The overall positive sentiment of the solar industry, even if some Chinese manufacturers decided to privatize. Of course, if President Trump decides to increase tariffs in the trade case, all of this may change rapidly." Venture capital Specifically, in 2017, the global solar industry venture capital reached 1.6 billion US dollars, involving 99 transactions, compared with 78 transactions in 2016, a total of 1.3 billion US dollars financing increased by 30%, which is mainly due to several large Indian Private equity transactions. In 2017, solar downstream enterprises accounted for 85% of total venture capital, and raised funds accounted for 1.4 billion US dollars. Thin film companies received $106 million in financing, service providers received $47 million in financing; photovoltaic technology companies invested $40 million, and System Balance (BoS) raised $36 million. The concentrated solar energy (CSP) category received $8 million in financing, and the concentrated solar energy (CPV) category received $6 million in financing. Among them, the largest single VC/PE transaction is the $200 million deal signed by LightsourceRenewableEnergy. In addition, ReNewPower also signed a financing agreement for two dollars each to reach $2. This was followed by GreenkoEnergy, which raised $155 million, HeroFutureEnergies raised $125 million, and CleanMaxSolar raised $100 million. Five of the six major solar venture capital fund transactions in 2017 came from India. In 2017, a total of 162 VC/PE investors participated in the capital round of investment, including Engie, AvistaDevelopment, DSMVenturing, InnoEnergy, Innogy, International Finance Corporation (IFC), Shell and Techstars and other 8 companies involved in multiple rounds of financing. Public market financing Public market financing remained steady in 2017, raising $1.7 billion from 33 transactions and $1.8 billion from 27 deals in 2016. During the year, three IPOs raised $363 million in funding for the Canadian Solar Infrastructure Fund, Canadian Solar Infrastructure Fund, New Energy Solar Fund, New Energy Solar Fund, and Clenergy. The size of debt financing announced in 2017 surged to $9.5 billion, compared to $6 billion in 2016. In 2017, there were six securitization transactions totaling $1.3 billion, which is the first time that securitization transactions have exceeded the $1 billion mark. Large-scale project financing announced in 2017 reached 167 transactions, raising a total of $14 billion, while 133 transactions in 2016 raised $9.4 billion. A total of 161 investors funded large-scale solar projects in 2017, with a cumulative installed capacity of 20.5 GW, compared with 153 investors in 2016, with a cumulative installed capacity of 5.9 GW. Top investors in large projects include Clean Energy Finance Corporation (CEFC), which invested in 13 projects, followed by Santander, which invested in eight projects, and the Commonwealth Bank of Australia and Siemens Financial Services each had six transactions. In 2017, 16 residential and commercial solar projects raised $2.4 billion, a 50% drop from the $4.9 billion raised by 30 funds in 2016. The main funding options include: SunlightFinancial, Sunnova, SolarMosaic, SolarCity and Spruce Finance. Since 2009, solar homes and commercial companies that provide leasing, power purchase agreements and loans have raised more than $24.8 billion in leasing and loan funds. In 2017, there were 71 M&A transactions in the solar industry, a slight increase from the 68 transactions in 2016. The solar downstream company involved 51 of these transactions. For example, Engie acquired three companies, while BayWa, Brookfield Asset Management, Horizo?n Solar, SivaPower, SolarSpectrum and Sonnedix each acquired two companies. The biggest and most significant transaction in 2017 was AES and Alberta Investment Management (AIMCo) acquired FTPPower (sPower) from FirTreePartners for $1.6 billion. In 2017, solar project acquisitions surged by 67%. A total of 228 large-scale solar projects were acquired over the year, with a cumulative installed capacity of over 20.4GW, compared with 218 acquisitions in 2016, with a cumulative installed capacity of 12.2GW. Mercom Capital also tracked the announcement of large-scale solar projects throughout the year, with a total of 992 announcements, with a total installed capacity of 50.1 GW. Among them, 187 announcements were issued in the fourth quarter, with an installed capacity of 10.6 GW. Auto Led Working Light,Car Work Light,Automotive Led Work Light,Led Car Work Light CHANGZHOU CLD AUTO ELECTRICAL CO.,LTD , https://www.cld-led.com

2017 global PV company financing reached US$12.8 billion, up 41%

Abstract global clean energy communications and consulting firm Mercom Capital today announced the solar industry in 2017 financing and M & A activity in the annual report, the total amount of financing for the solar industry companies worldwide to $ 12.8 billion, an increase of 41 over 2016's $ 9.1 billion .. .